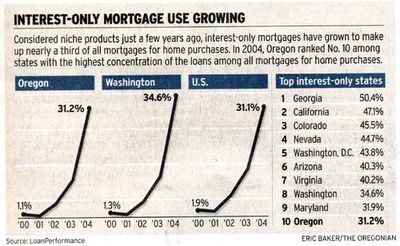

Interest-only mortgages help spur sales, but experts worry that borrowers and the economy may feel the pinch down the road

Yesterday we discussed how credit based "booms" always bust, bubbles always over inflate until they burst. In The Oregonian they discuss how the housing bubble is being hyper inflated by the interest only loan.

(graphic courtesy of the Oregonian Print Edition)

Nearly one-third of Oregon home buyers used interest-only mortgages in 2004, helping to whip up an already whirlwind housing market and prompting concerns that many homeowners have stretched beyond their means.This so called "recovery" has been based entirely on housing, low interest rates and credit. As we discussed yesterday the current economic climate is explained by The Austrian Theory of Trade Cycle:

Such borrowers pay interest but no principal on their mortgages for the first five to 10 years. As a result, they can save $200 on monthly payments on an average-priced Portland-area home, compared with those of conventional fixed-interest loans.

But their payments can shoot way up after the interest-only period ends and principal-and-interest payments begin.

[....]

Economists worry that by tempting renters to strain their finances to buy homes, interest-only loans are pumping extra air into what may turn out to be a real estate bubble -- a market with prices that are not supportable over the long term.

They also worry that by subjecting loan holders to a heightened risk of rising interest rates, such loans could magnify the effects of a real estate downturn on the loan holders as well as the economy.

The Austrian theory of the business cycle emerges straightforwardly from a simple comparison of savings-induced growth, which is sustainable, with a credit-induced boom, which is not. An increase in saving by individuals and a credit expansion orchestrated by the central bank set into motion market processes whose initial allocational effects on the economy's capital structure are similar. But the ultimate consequences of the two processes stand in stark contrast: Saving gets us genuine growth; credit expansion gets us boom and bust.While the easy credit flowed into the tech industry in the 90's it has flowed into the housing market during this economic cycle. Like the tech bubble was not sustainable neither is the housing bubble. The interest only loans are only artificially inflating the housing bubble so that when it finally bursts the impact will be more severe.

So how does an interest only loan work and what are the risks?

Most interest-only loans have interest rates that adjust at some point, though some have fixed rates. In common versions, borrowers pay interest for five years at a fixed interest rate. In the sixth year, the interest rate can rise, as much as doubling the initial monthly payments by the seventh year in the worst-case scenario.In other words that home you bought as an investment is now a liability. It's no longer a matter of if the bubble will burst but when and the more it's inflated the worse it will be for the economy.

If a home's value rises by 5 percent to 20 percent in five years, a homeowner can use the equity to refinance into a conventional 30-year, fixed-interest loan, brokers said. On a $200,000 house, a 20 percent increase in value would give a borrower $40,000 in equity.

But if home prices hold steady, a borrower who put up no down payment and paid no principal in the first five years could be in for a shock. In the sixth year, higher interest rates could take hold, scanty equity could bar refinancing, and the borrower could be stuck with higher payments.

But things could be even worse.

If a homeowner needed to sell, and home prices were down 20 percent after the first five years, the owner would be looking at a $200,000 mortgage for a house worth $180,000. In selling, the homeowner would have to pay the bank the difference between the sales price and loan balance.

"You're betting that home prices are going to continue to rise," said John Mitchell, an economist with U.S. Bank in Portland. "You worry if that doesn't happen -- let's say the person five or 10 years from now goes to sell -- they better bring their checkbook."

Hey I agree 100% agree with the last few comments. This blog has great opinions and this is why I continue to visit, thanks! ##link#

ReplyDelete